We see preachers driving expensive cars, buying private jets, and building enormous homes. Witnessing the blatant flaunting of wealth, we wonder how churches, especially the megachurches littering the US, can possibly be considered nonprofits? We shake our heads in disgust, feeling helpless witnessing the corruption — sometimes right in our town or city.

Those pastors laugh and laugh after obtaining their nonprofit status, submitting their fraudulent statements, and evading taxes. They laugh and laugh from their multi-million dollar homes as the rest of us struggle to eke a living from thankless jobs. We look to the US government, believing it completely blind, having missed such greed.

We are misguided.

Retribution awaits those charlatans, not in the afterlife. Prepared to lunge from the public trust, she growls, ready to take down those thieves. She snarls, hungry to sink her fangs in filers of suspect returns, corrupt corporations, and, yes, nonprofit violators.

She is the IRS!

No, the IRS is no sleeping sloth of bureaucracy; she is a rapacious tax tiger, mauling corporations, billionaires, and churches with the same hunger for public revenue. Answering only to the almighty tax code, the IRS is the true savior overseeing Churches with the law that dictates they must use funds appropriately, demanding that directors and officers NOT use the church’s funds for personal gain.

But wait! The IRS roars with more ferocity!

She gnashes her teeth at those many Churches violating the law banning political activity. The IRS is prepared to eviscerate that church you witnessed holding a Republican caucus just last week because, under the law, Churches are banned from political participation with “no substantial part of the activities of which is carrying on propaganda, or otherwise attempting to influence legislation.”

The great tax code has spoken, with rules dictating how churches “and all 501(c)(3) organizations, can stay within the law regarding the ban on political activity.” Etched in plain English for everyone to see, the rules list right on the IRS site.

Despite what many people believe, the IRS is a skilled huntress, preying on the corrupt, but she can’t see all the fraudsters and corrupt organizations stealing society’s lifeblood.

Not to worry!

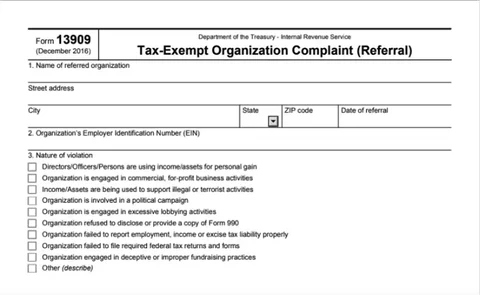

The IRS provided us with the tool to help her make the kill. Using the IRS complaint Form 13909, Tax-Exempt Organization Complaint (Referral), and any supporting documentation, you can direct that tigress to the fraud churches commit.

You can access the form here.

You can report Christian Church fraud nonstop, and rest assured, the tiger will protect your anonymity. Now you know what to do when you see that preacher driving through town in his Benz, or when the new Mega Church opens a coffee bar, or when your preacher tells the congregation to vote Republican, or when those “volunteers” pass out pamphlets for candidates after church services. Yes, Christian fraudsters think their slick and try to dance around the tax tiger. They believe they are untouchable, using their misappropriated nonprofit funds for attorneys. Fret not! Just keep on reporting them because that legal pit fight is what the IRS does best.

It’s just up to us to unleash the tiger!